A BIWEEKLY SAVING PLAN FOR FOOD LOVERS

Savoring Financial Success in the Kitchen: A Biweekly Savings Plan for Food Lovers

For those who cherish the art of cooking, the kitchen is more than a workspace-it’s a sanctuary of creativity and pleasure. Yet, passion alone doesn’t always translate into sustainable culinary indulgence. That’s where financial strategy enters the picture.

This guide introduces a biweekly savings plan tailored for food lovers-a structured approach to funding your culinary ambitions without sacrificing financial security. Whether your goals include premium ingredients, high-end kitchen tools, gastronomic travel, or advanced cooking courses, this plan ensures that every culinary dream can be realized with confidence and consistency. As passionate lovers of all things culinary, we understand the joy and fulfillment that a well-cooked meal can bring. In this exclusive guide tailored to food lovers, we’re diving into the realm of financial savvy specifically, a Biweekly Savings Plan designed to empower you to savor not just the flavors in your kitchen but the sweet taste of financial success. . Here’s to the perfect blend of culinary creativity and financial savvy. Happy cooking and saving

Section 1: The Secret Ingredient – Biweekly Savings

- Tip: Automate contributions every two weeks

- Benefit: Consistency = compounded growth

- Visual: Calendar icon highlighting every other Friday

Section 2: Set Your Culinary Goals

- Upgrade tools & appliances

- Try exotic ingredients

- Culinary travel experiences

- Visual: Chef hat icon + checklist graphic

Section 3: Automate Your Culinary Fund

- Direct deposit a portion of your paycheck

- Dedicated fund ensures steady growth

- Visual: Bank icon with arrow flowing into a pot or mixing bowl

Section 4: Low-Risk Investments for Culinary Dreams

- High-yield savings for gadgets & ingredients

- Low-risk funds for travel & workshops

- Visual: Piggy bank with chef knife and globe icon

Section 5: Emergency Culinary Fund

- Cover unexpected opportunities or ingredient splurges

- Ensure creative freedom without financial stress

- Visual: Safety net icon over cooking utensils

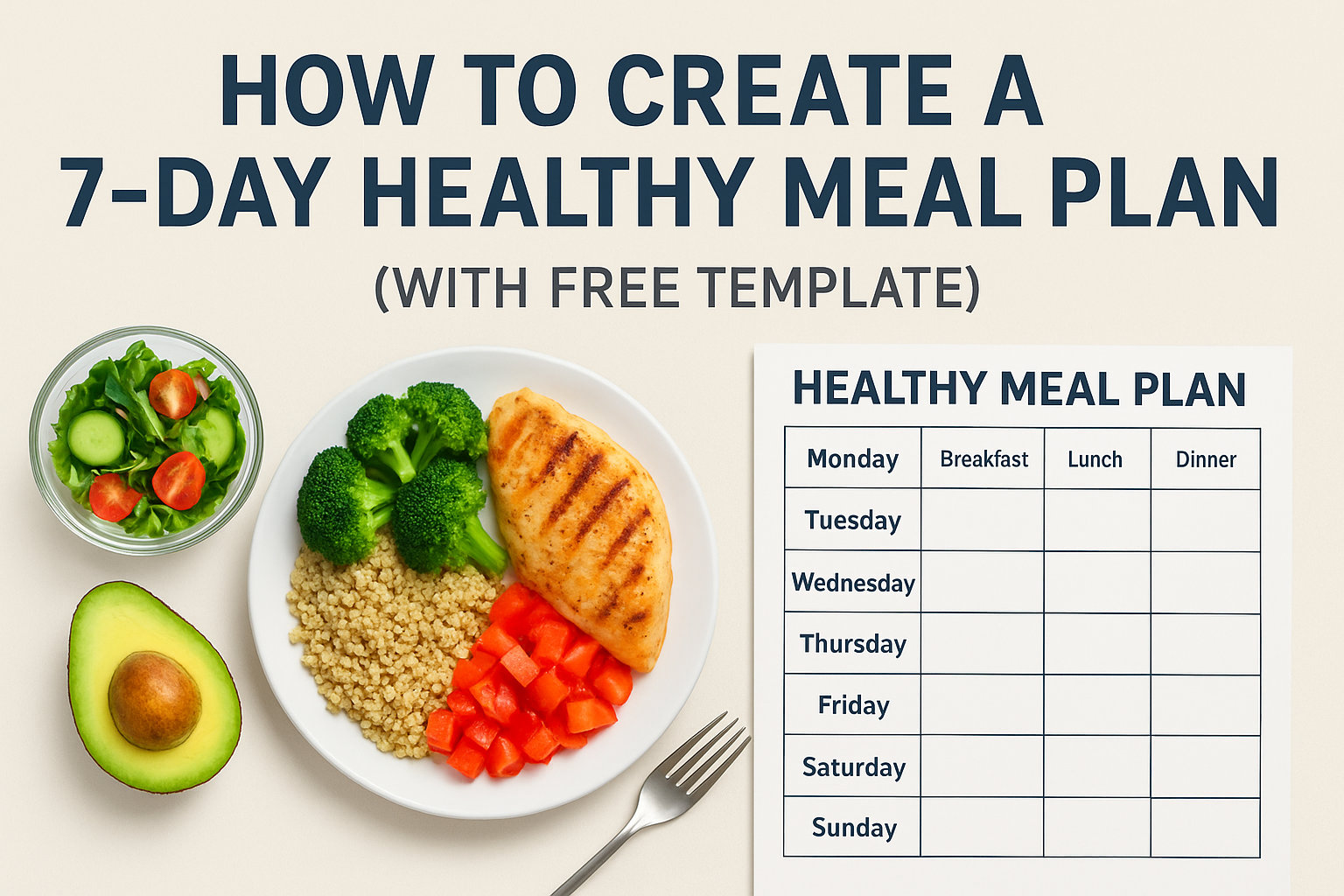

Section 6: Smart Budgeting & Tracking

- Track ingredient costs, workshops, and kitchen upgrades

- Adjust biweekly contributions as goals evolve

- Visual: Graph or chart showing growth over time

Be ready to seize the moment when inspiration strikes, knowing your culinary finances are secure.

Let’s Engage!

What’s your ultimate culinary goal—upgrading your kitchen, trying a new cuisine, or attending a cooking class abroad? Share your plans in the comments below and let us inspire each other to turn food dreams into reality